6th May

6th May

Pay Per View

Pay Per View

Pay Per View

Pay Per View

Pay Per View

E-Learning

A blended, self-paced e-learning programme with e-certificate

Available for enterprises as well as individuals

Creating

Financially Intelligent Organisations™

Globally

Creating financially intelligent organisastions™

Training Programmes

All the programmes can be accessed physically as well as virtually

Video Series

Live Programmes

Lamcon has been at the forefront of creating original content and delivering world-class financial education for over three decades now.

In-Company Training Programmes

Training Programmes Open to Public

Guest Talks

e-Learning Programme

Self-paced, high quality, blended e-learning programme accessible from anywhere in the world (leading to a certificate)

Corporations wishing to train large numbers of employees can obtain bulk licences here.

Romancing the Balance Sheet

Romancing the Balance Sheet is a 12 module e-learning programme on finance management based on the chapters from the book by the same name.

This programme provides a comprehensive insight into the financial concepts and principles that everyone needs to understand in order to take financially intelligent decisions and offers a cost-effective method of imparting financial literacy across the organisation.

Video-Based Training

Anil Lamba on Finance is a series of training videos designed to give a complete understanding of finance management.

Corporations wishing to train large numbers of employees can obtain bulk licences here.

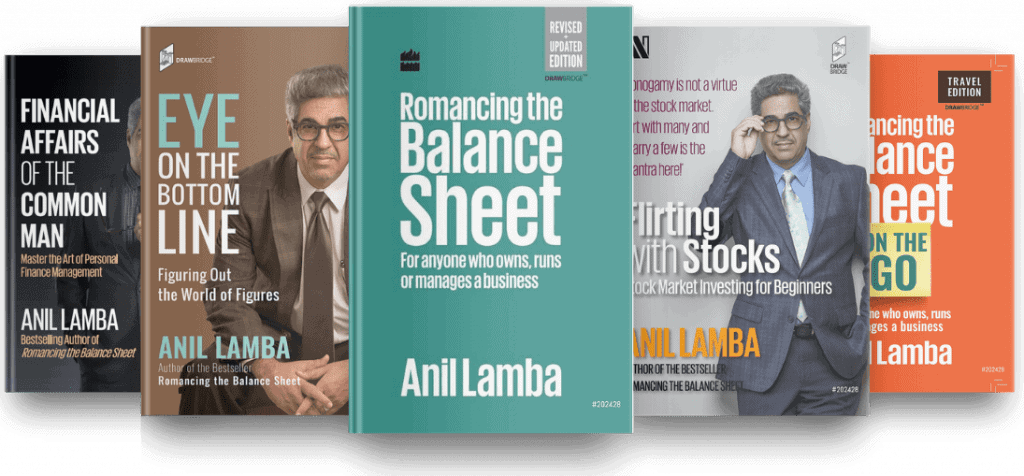

Books

Bestselling books on finance authored by Dr Anil Lamba. Limited signed copies are available.

Corporations wishing to give books to a large number of employees can obtain bulk copies here.

Financial mismanagement is the single biggest cause of business failures worldwide.

A first of it's kind certification in the world

Financially Intelligent Organisation™

Lamcon certification for management accounting processes & financial acumen.

An organisation is deemed to be financially intelligent when:

i) timely and relevant information is generated and delivered to the appropriate individuals and

ii) the recipients of the information are trained to read, understand and interpret the information received and take necessary actions based on it.

Our Reach

Our clients include some of the fastest growing companies across the world.

Financial Literacy For All™

A Lamcon Initiative

Share the TED Talk

Listen, read & watch